If you need cash fast, title loans Scottsdale from North Scottsdale Loan & Gold offer a transparent, straightforward solution. Conveniently located at 7126 E Shea Blvd, Scottsdale, AZ 85254, we’ve proudly served Scottsdale, Phoenix, and Paradise Valley since 2011, helping Arizona residents access emergency funds quickly—without credit checks or unnecessary paperwork.

Backed by our partnership with Phoenix Title Loans, LLC, our title loans Scottsdale program is designed to be flexible, discreet, and efficient. In many cases, approvals can be completed in as little as 30 minutes, with same-day funding available.

What Are Auto Title Loans?

Auto title loans are collateral-based loans that use your vehicle’s lien-free title as security. You bring in your vehicle and title, we perform a verbal assessment of its value, and determine what we’re willing to lend based on current market conditions and vehicle condition.

Important: We do not provide formal appraisals. We provide assessments, which are free, verbal evaluations and not written valuation documents for insurance or legal use.

Depending on the vehicle type and loan structure, customers may be able to retain possession of their vehicle while the loan is active.

Vehicles We Loan On

We offer title loans in Scottsdale on a wide range of titled assets, including:

- Cars & Trucks

- Motorcycles

- RVs & ATVs

- Boats & Jet Skis

- Golf Carts & Tractors

- Specialty and custom vehicles

If it has a title and verifiable value, our team can evaluate it.

Motorcycle & Specialty Vehicle Storage Policy

For motorcycle title loans and pawn loans, the motorcycle is typically stored in our monitored, secure facility until the loan is paid in full.

- - Approximately 95% of motorcycle loans require storage

- - This policy also applies to certain custom vehicles, specialty assets, and commercial equipment

Exceptions are rare and may be considered only for customers with strong mitigating factors such as higher income, strong credit, or property ownership. These decisions are made on a case-by-case basis and are not guaranteed.

How Our Title Loans Scottsdale Process Works

1. Vehicle Review & Assessment

Bring in your vehicle and lien-free title. One of our experienced pawnbrokers will confirm basic details such as make, model, mileage, and overall condition, then provide a verbal assessment based on resale and market value.

2. Receive Your Offer

You’ll receive a same-day loan offer based on your vehicle’s equity. There is no obligation to accept, and no pressure if you choose not to proceed.

If you leave and return at a later time, a new assessment will be completed, and the offer may vary slightly depending on market conditions, vehicle condition, or the evaluating pawnbroker.

3. Complete the Paperwork

With a valid Arizona ID and your signature, the process is completed. Most title loans Scottsdale are finalized within 30 minutes.

4. Get Funded

Once approved, funds are issued the same day. Vehicle possession depends on the asset type and loan terms.

What You’ll Need for Title Loans Scottsdale

To qualify, simply bring:

- - Your vehicle

- - A lien-free title in your name

- - A valid Arizona driver’s license or ID

That’s it. Our team handles the rest and walks you through every step.

Vehicle Possession & Loan Structure Explained

Vehicle possession during a loan depends on the type of vehicle, how the loan is structured, and the customer’s relationship with our shop.

For standard passenger vehicles, such as cars and trucks, customers are typically able to retain possession of their vehicle while repaying the loan. In many cases, these vehicles are a customer’s primary or only form of transportation, and our title loan structure is designed to accommodate that need whenever possible.

For other asset types—such as motorcycles, RVs, semi trucks, boats, jet skis, and specialty vehicles—the loan is more often structured as a pawn loan rather than a traditional title loan. In these situations, the asset is generally placed into our secure, monitored storage for the duration of the loan.

This approach helps protect both the customer and the lender and is standard for higher-risk or non-essential-use vehicles.

Preferred Customers & Loan Flexibility

A customer’s history with our shop matters.

Recurring customers and those who qualify for a Preferred Title Loan may be eligible for:

- - More flexible loan structures

- - Expanded term options

- - Greater consideration regarding storage requirements

Preferred status can make a significant difference in how a loan is structured; however, all decisions are made case by case and are based on factors such as the asset type, value, condition, and overall risk profile.

While exceptions to storage requirements are rare, established relationships and strong customer profiles are always taken into consideration.

At North Scottsdale Loan & Gold,

we believe in transparency, professionalism, and tailored lending solutions. Every title loan or pawn loan is evaluated individually, with clear explanations of terms, storage requirements, and repayment options before you move forward. Whether you’re a first-time visitor or a returning preferred customer, our goal is to provide a respectful, straightforward experience that helps you access the funds you need with confidence. Visit us at 7126 E. Shea Blvd., Scottsdale, AZ 85254, or speak with one of our specialists to learn which option makes the most sense for your situation.

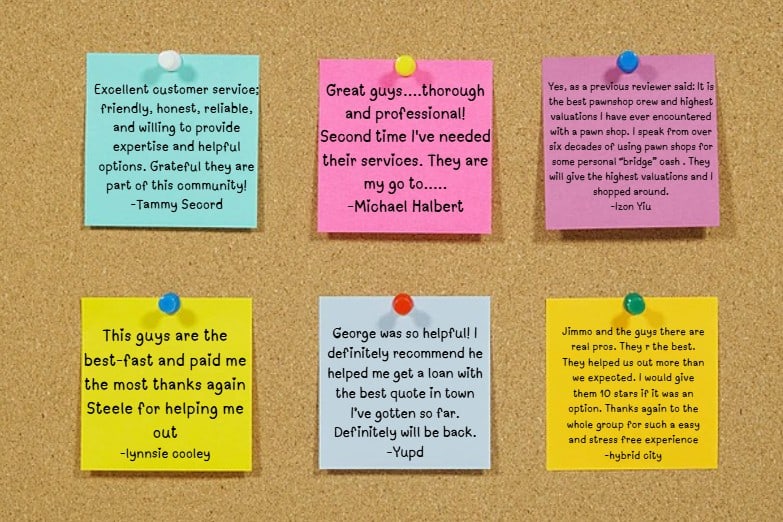

Not So Sure? Read Some of Our Top Reviews

North Scottsdale Loan & Gold has been the Valley’s trusted name for title loans Scottsdale since 2011—offering fast approvals, fair rates, and the professional service you deserve. Visit us today at 7126 E Shea Blvd, Scottsdale, AZ 85254 or apply online to see why Scottsdale, Phoenix, and Paradise Valley residents rely on us for quick, secure, and honest title loans.

Loan Terms and Conditions

- Must be 18+ with a valid Arizona driver’s license

- Preferred pawn loans: 90-day minimum, renewable

- Preferred title loans: 90 days up to 60 months

- No initial loan fee; $5 police ticket fee on preferred pawn loans

- Maximum APR: 35.99%