Fast & Flexible Boat Title Loans

in Scottsdale, AZ

When you’re in a tight financial spot and own a boat, there’s a fast and confidential way to access cash—boat title loans. At North Scottsdale Loan & Gold, we help residents of Scottsdale, Phoenix, and Paradise Valley leverage the value of their watercraft to obtain funds quickly and discreetly. Whether you’re facing an unexpected expense or need short-term liquidity, our boat lending options are designed to be straightforward and transparent.

In many cases, qualified customers can complete the process the same day, with funding issued once loan terms are finalized.

What Are Boat Title Loans?

Boat title loans are collateral-based loans that use your lien-free boat title to secure financing. If you own your vessel outright, loan eligibility is based on the boat’s value—not your credit score.

At North Scottsdale Loan & Gold:

- - No credit checks are required

- - Approval is based on asset value and condition

- - Evaluations are conducted in-house by experienced professionals

We provide verbal assessments, not written appraisals. These assessments are free of charge and reflect current resale and market conditions.

For general consumer education, the Federal Trade Commission explains how title-based lending works and what borrowers should understand before proceeding.

Why Choose a Boat Title Loan?

Boat title loans are a practical option for many Arizona residents because they offer:

- - No Credit Check Required – Credit history does not determine eligibility

- - Same-Day Funding Available – Many loans are completed in a single visit

- - Structured Loan Terms – Amortized options typically ranging from 12 to 36 months

- - Confidential Lending – Loans are not reported to credit bureaus

You can also explore how this approach applies to other vehicles on our Auto Title Loans page.

When you’re in a tight financial spot and own a boat, there’s a fast and confidential way to get the money you need—boat title loans. At North Scottsdale Loan & Gold, we offer a hassle-free solution for residents of Scottsdale, Phoenix, and Paradise Valley who want to leverage their watercraft for immediate cash. Whether you’re facing unexpected expenses or just need a quick boost, our boat title loans can get you out the door with money in hand in 45 minutes or less.

What You’ll Need for a Boat Title Loan

To begin the process, please bring:

- - Your lien-free boat title

- - A valid Arizona driver’s license or state ID

- - Your physical boat for inspection and assessment

We do not require proof of income, pay stubs, or employment verification.

Getting Started: Pre-Approval Options

You can start the process in whichever way is most convenient:

- - Online Application – Submit basic details and photos for review

- - Email – Send photos and vessel information to our team

- - In-Store Visit – Stop by our Scottsdale location to speak directly with a specialist

Online and remote submissions are reviewed during business hours, and responses are typically prompt.

In-Store Assessment & Loan Offer

Once your boat is brought to our secure facility, a trained associate will conduct a verbal assessment based on:

- - Year, make, and model

- - Overall condition

- - Operational status

- - Market demand and resale value

Following the assessment, we’ll present a loan offer. If you choose to proceed, we’ll clearly review the loan amount, term length, interest structure, and payment schedule before anything is signed.

Assessments are free and come with no obligation.

Understanding Boat Loan Terms

Boat title loans are typically amortized, meaning:

- - Payments are made monthly

- - Each payment includes both principal and interest

- - Terms generally range from 12 to 36 months

All loan details are disclosed upfront. There are no hidden fees or surprise charges.

Customers exploring options due to credit challenges may also find helpful information on our bad credit title loans page.

Boat Title Loans vs. Boat Pawn Loans

Depending on the vessel and loan structure, a boat loan may be issued as either a title loan or a pawn loan.

Boat Title Loans

- - Longer terms (12–36 months)

- - Monthly payments

- - No prepayment penalties

Boat Pawn Loans

- - Short-term (typically up to 90 days)

- - Lump-sum payoff at the end

- - Often include early payoff incentives

For boats and other recreational or specialty vehicles, pawn loans are common, and the vessel is generally placed into secure, monitored storage for the duration of the loan.

Preferred Customers & Loan Flexibility

A customer’s history with our shop matters.

Recurring customers and those who qualify for a Preferred Title Loan may be eligible for:

- More flexible loan structures

- Expanded term options

- Greater consideration regarding storage requirements

Preferred status can make a significant difference in how a loan is structured; however, all decisions are made case by case and are based on factors such as the asset type, value, condition, and overall risk profile.

While exceptions to storage requirements are rare, established relationships and strong customer profiles are always taken into consideration.

Why Choose North Scottsdale Loan & Gold?

We’re a local, established lender—not an anonymous online operation. Customers choose us because we offer:

- - A convenient location at 7126 E. Shea Blvd., Scottsdale, AZ

- - Over a decade of experience serving Scottsdale, Phoenix, and Paradise Valley

- - Expertise in high-value assets, including boats and specialty vehicles

- - A regulated, transparent lending process

Serving the Greater Phoenix Area

Whether you boat at Lake Pleasant, Saguaro Lake, or elsewhere in the Valley, our boat lending services are available to customers throughout:

- - North Scottsdale

- - Paradise Valley

- - Phoenix and surrounding communities

We’re proud to provide an asset-based lending alternative focused on clarity, discretion, and professionalism—not credit scores.

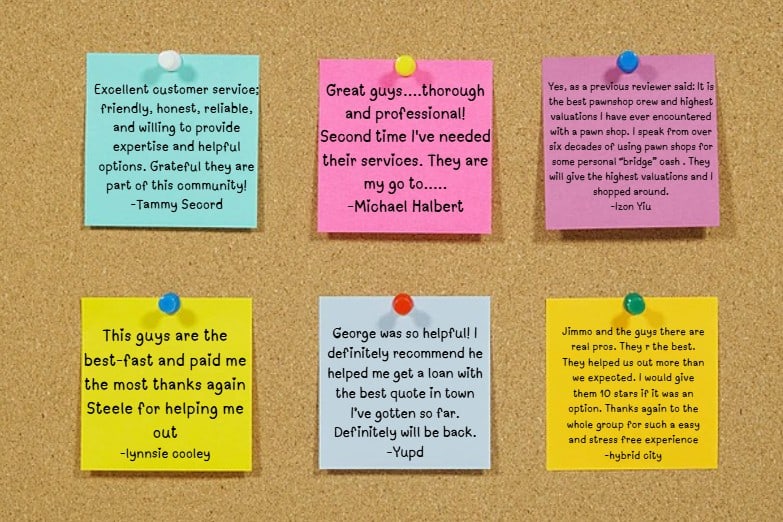

Not So Sure? Read Some of Our Top Reviews

North Scottsdale Loan & Gold has been the Valley’s trusted name for title loans Scottsdale since 2011—offering fast approvals, fair rates, and the professional service you deserve. Visit us today at 7126 E Shea Blvd, Scottsdale, AZ 85254 or apply online to see why Scottsdale, Phoenix, and Paradise Valley residents rely on us for quick, secure, and honest title loans.

Contact Us Today!

Loan Terms and Conditions

- Must be 18+ with a valid Arizona driver’s license

- Preferred pawn loans: 90-day minimum, renewable

- Preferred title loans: 90 days up to 60 months

- No initial loan fee; $5 police ticket fee on preferred pawn loans

- Maximum APR: 35.99%