Motorcycle Title Loans Scottsdale | Tempe | Phoenix

Low Rates, Fast Cash Title Loans

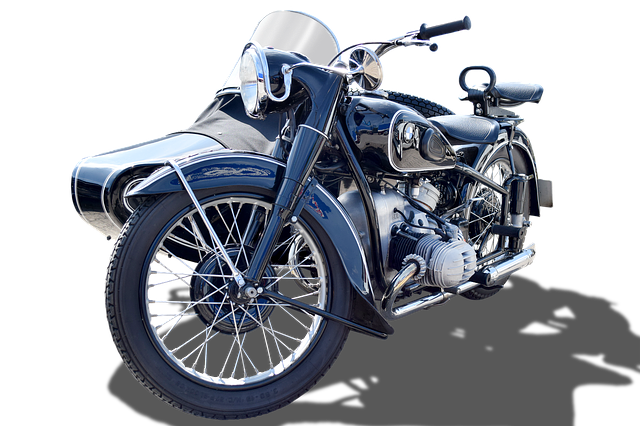

When you need fast access to cash and own a motorcycle free and clear, a motorcycle title loan can be an efficient and discreet solution. At North Scottsdale Loan & Gold, we help Arizona residents leverage the value of their motorcycles through secure, locally handled motorcycle title loan options designed for flexibility and transparency.

Located at 7126 E. Shea Blvd in Scottsdale, Arizona, North Scottsdale Loan & Gold has served North Scottsdale, Phoenix, and Paradise Valley since 2011. As one of North Scottsdale’s premier luxury item buyers and pawn shops, we specialize in collateral-based lending for high-value assets, including motorcycles, vehicles, and specialty equipment.

What Is a Motorcycle Title Loan?

A motorcycle title loan is a secured loan that uses your motorcycle’s title as collateral. If your bike is paid off and titled in your name, you may qualify for a motorcycle title loan based on the motorcycle’s assessed value rather than your credit score. There are no traditional credit checks, and approval is determined primarily by the motorcycle itself.

Unlike unsecured loans or credit cards, a motorcycle title loan is based on tangible equity. This allows borrowers to access funds quickly without lengthy underwriting. For a general overview of how title loans function, Experian provides a detailed explanation of how title loans work and what borrowers should know before applying.

Motorcycles That May Qualify for a Motorcycle Title Loan

We work with a wide variety of motorcycles for motorcycle title loan consideration, including:

- - Cruisers and touring motorcycles

- - Sport bikes and superbikes

- - Dual-sport and adventure motorcycles

- - Custom and modified motorcycles

- - Limited-production and collector motorcycles

Each motorcycle title loan is evaluated individually. Market demand, condition, mileage, year, and overall resale potential all influence eligibility and loan structure.

How Our Assessments Work

At North Scottsdale Loan & Gold, every motorcycle title loan begins with a professional assessment, not an appraisal. We do not provide written or certified appraisals for insurance, legal, or estate purposes. Our assessments are performed solely to determine loan eligibility and loan value.

When assessing a motorcycle for a motorcycle title loan, our pawnbrokers consider:

- - Make, model, and year

- - Mileage and usage history

- - Mechanical and operational condition

- - Cosmetic condition and modifications

- - Current market demand and resale potential

Reference tools such as Kelley Blue Book may be used when applicable; however, many motorcycles—especially custom, vintage, or specialty bikes—fall outside standard valuation guides. In those cases, market desirability and resale demand carry more weight.

If you already have a written appraisal from another source, you are welcome to bring it with you. While we do not issue appraisals, outside documentation may be taken into consideration during the assessment process and could help support a higher motorcycle title loan amount.

All assessments are provided at no charge. If a borrower chooses not to move forward and returns later, a new assessment will be completed to reflect current market conditions and vehicle condition at that time.

Do You Keep the Motorcycle?

In most cases, a motorcycle title loan requires the motorcycle to be stored in our secure, monitored facility for the duration of the loan. This policy applies to approximately 95% of motorcycle loans and helps protect both the borrower and the lender.

There may be rare exceptions for borrowers with higher income, strong credit, or property ownership; however, storage is the standard requirement for motorcycle title loan agreements. The motorcycle is released immediately once the loan is paid in full.

How Much Can You Borrow?

Loan amounts for a motorcycle title loan vary based on the assessment but typically range from a few hundred dollars to tens of thousands, depending on the motorcycle. Loan terms generally start at 90 days and may extend longer depending on the loan structure.

Borrowers exploring additional vehicle-based options may also want to review our other services, including auto title loans, bad credit title loans, classic car title loans, RV title loans, and boat title loans.

Why Choose a Local Motorcycle Title Loan Lender?

Choosing a local lender for a motorcycle title loan matters. Our team understands Arizona title requirements and operates in full compliance with state and county regulations. We provide clear explanations, transparent loan terms, and a professional environment focused on confidentiality.

Before signing any agreement, we walk borrowers through repayment expectations, storage requirements, and total loan cost. For additional consumer education, the Federal Trade Commission outlines important considerations in its guide on what to know about payday and car title loans.

What You’ll Need to Apply

Applying for a motorcycle title loan is straightforward. Most borrowers will need:

- - A valid government-issued ID

- - A clear motorcycle title in their name

- - Proof of Arizona residency

- - Basic information about the motorcycle

- - Proof of income or ability to repay

You can also start the process through our secure online title loan application to save time before visiting our Scottsdale location.

Motorcycle Title Loans in North Scottsdale, Phoenix, and Paradise Valley

If you’re searching for a motorcycle title loan in North Scottsdale, Phoenix, or Paradise Valley, North Scottsdale Loan & Gold offers a reliable and discreet solution. Our professional assessments, secure storage, and flexible loan structures make it easier to access the value of your motorcycle without selling it outright.

To review additional terms and consumer disclosures, visit our preferred title loans disclosure page. When you’re ready, stop by our Shea Boulevard location or speak with our team to determine whether a motorcycle title loan is the right fit for your financial needs.